Essential End-of-Life Documents

Discussing your end-of-life wishes can be difficult. Death is a taboo subject for many, and it might feel as if you’re burdening family members by bringing up the topic. In actuality, end-of-life planning can soothe your fears about the future and alleviate your family members’ stress. You can clarify what’s important while taking care of your paperwork and preventing the responsibility from being shifted to your family when you die.

Learn about the crucial end-of-life documents, and follow our planning checklist to ensure your wishes are fulfilled and your family is cared for.

Jump to a specific end-of-life document:

- Living Will

- Last Will and Testament

- Living Trust

- Financial Power of Attorney

- Letter of Intent

- Life Insurance

- Pet Trust

- Organ Donor Card

What Are End-of-Life Documents?

End-of-life document preparation is the process of getting your medical, legal, personal and financial affairs in order for when you pass away. While different for everyone, these documents will typically include decisions on your property, healthcare and finances. By gathering the necessary documents ahead of time, you can relieve your family members of this massive administrative undertaking when you pass. Some examples of these necessary documents or information needed are listed below.

Medical documents for end-of-life planning may include:

- List of current physicians and medical specialists

- Current list of medications you are taking

- Previous and current medical diagnoses and conditions

- Previous surgeries

- Primary and secondary Medical insurance information

- MOLST Form (Medical Orders for Life Sustaining Treatment)

- Hospital preference

Personal information for end-of-life paperwork might include:

- Full legal name

- Social Security number

- Date and place of birth

- Legal residence

- Names and addresses of spouse and children

- Employers and dates of employment

- Education records

- Military records

- Contact information for your close friends, doctors, relatives, lawyers and financial advisors

End-of-life legal documents and records may include:

- Revocable or Irrevocable Trust(s)

- Living Will

- Power of Attorney (Financial or Health)

- Advanced Directives

- Contracts

- Location of your home’s original deed of trust

- Location of your living will and other legal paperwork with legal signature

- Location of your birth, adoption, marriage, citizenship or divorce certificates, as applicable

Financial records are equally essential to include in your end-of-life planning. These documents might consist of:

- Sources of income

- Bank numbers from your checking, savings or credit union accounts and bank names

- Login details for online accounts

- Credit and debit card names and numbers

- Assets such as a pension, IRA(s), 401(k)s or interest

- Investment income from stocks, bonds and property

- Financial fiduciary names and contact information (Financial accountant, broker, investment advisor)

- Mortgages and debts, as well as how and when they’re paid

- Life, health, long-term care, home or car insurance information with policy numbers, agents’ names and phone numbers

- Copy of most recent income tax return

- Car title and registration

- Location of a safe deposit box and key

No one plans to be terminally ill or disabled. When you take the time to make decisions about your health and finances in advance, you eliminate the stress and need for your family members to do it for you. And if you have a family member nearing the end of their life or struggling with illness, gathering the necessary end-of-life paperwork can lift a lot of stress off their shoulders.

Top 8 Essential End of Life Documents

At the end of our lives, we often cannot express our needs at a time when that information is the most crucial. If you have a terminal illness or simply want to prepare for emergencies, it’s a good idea to create legal documents with your doctors or lawyer and discuss these wishes with family members. By completing this task as early as possible, you can ensure your wishes are followed and your family is taken care of when you pass away. Learn about the essential documents you might consider while creating an end-of-life plan:

1. Living Will

One of the most well-known documents for end-of-life planning is a living will. People who face terminal illness often create a living will or health care directive to communicate their wishes regarding their end-of-life care if they cannot communicate on their own. A living will can provide your preferences for prolonging your life if you cannot speak without the help of a medical team. These preferences might concern medical treatments such as:

- Medication

- Pain management

- Tube feeding

- Resuscitation

- Dialysis

- Organ and tissue donation

There are other separate legal documents to communicate your preferences, such as a do not resuscitate (DNR) order that specifies that you don’t want life-sustaining treatment after cardiac or respiratory arrest. But whether you have the additional documentation, it’s always best to make your wishes known in a living will.

2. Last Will and Testament

A recent study showed just 46% of adults have a last will and testament. Yet, if you own any assets or have family members depending on you, creating a last will can take away the burden of planning and ensure your family is cared for. A last will and testament shouldn’t be confused with a living will, which outlines your wishes while you’re alive but in a terminal state.

A last will and testament documents your wishes for what happens after you die, such as funeral preferences, instructions for any outstanding debts and disbursement of your assets. This includes the physical assets — your house, car or possessions — and your financial assets from your bank and investment accounts. You might also name a guardian for your minor children and the person who will care for your pets.

Having a will streamlines probate — the legal and court-driven process of distributing assets — by ensuring your property goes to the correct people. Beneficiaries are the people or organizations you name to receive your property. You can also name an executor, who is the person who distributes your estate to your heirs and carries out the instructions in your will after you die.

3. Living Trust

Like a will, a living trust helps you manage and distribute your financial assets after you pass away. However, unlike a will, a living trust owns your assets as a legal entity. You can outline how your assets should be distributed in a living trust. You can also place valuable assets into a living trust, such as real estate, vehicles or bank accounts. When you die, your assets will distribute as outlined in your trust without probate.

Living trusts require more management than wills since you’ll need to transfer new property to them as you acquire it, though they can come with many advantages. For instance, since a trust doesn’t require probate, your family will save time and keep their privacy when you opt for one.

When you set up a living trust, it’s best to name a successor to manage your assets if you become disabled or pass away. You can also choose beneficiaries to receive the trust property after you die, and the living trust will streamline the process of transferring your assets.

4. Financial Power of Attorney

When you set up a financial power of attorney (POA), you make it possible for a person of your choosing to act on your behalf legally and handle your financial affairs. The person you choose to have POA is referred to as an agent, attorney-in-fact or proxy. A financial POA is a highly customizable document you can use to designate agents to help with specific tasks, such as selling property, or to take over all financial responsibilities should you become disabled or incapacitated.

When completing a financial POA, you should be aware of the different levels of power that you can give to your agent. These different levels include:

- General power of attorney: This document lets your agent pay bills, sign legal documents and act on your behalf. However, these powers end when you can no longer make decisions or pass away.

- Durable power of attorney: A durable power of attorney allows the agent to make financial decisions on your behalf if you’re in a coma or cannot communicate due to incapacitation.

5. Letter of Intent

A letter of intent is a personal way of expressing your end-of-life decisions to your beneficiaries. Aside from listing the reasoning behind the instructions outlined in your will, it can also include:

- The location of your legal and financial documents

- Usernames and passwords for online accounts

- Care instructions for pets

- Funeral arrangement preferences

While it’s not legal paperwork, a letter of intent can clear any confusion and aid family members through the estate process.

6. Life Insurance

Taking out a life insurance policy might be worth considering as part of your end-of-life plan. Life insurance can help protect those who rely on you financially and provide a substantial payout when you pass away. The payout might cover your family’s day-to-day or long-term expenses, depending on the amount of coverage you choose. Some people also use life insurance to pay for funeral expenses or probate costs. This way, your family members won’t have to worry about planning while in the grieving process.

To determine the coverage you need, consider your age and household expenses. You can purchase a life insurance policy by researching providers online and sitting down with an agent to determine your needs and options.

7. Pet Trust

If you have pets, you’ll want to ensure they’re cared for after your passing. While you can choose a caregiver in your will and set aside money for your pet’s care, a pet trust takes this a step further by ensuring your pets are cared for exactly how you prefer after you die. With a pet trust, you fund your trust with assets to pay for your pet’s care and leave instructions for using the funds, such as for your pet’s medical treatments or favorite toys. A pet trust might also be ideal if you:

- Have a pet with a long life span, such as a tortoise or parrot

- Have a pet with special needs or a disability that requires costly medical attention

- Wish to offset the costs of your pet’s regular care after your die

8. Organ Donor Card

If you wish to give back to someone in need after you die, you might consider applying for an organ donor card. It can be tough to think about what happens to your body after you die, let alone donating organs. However, choosing to be an organ donor is a compassionate and meaningful decision. Being an organ donor might also help your family and friends cope with your loss, knowing that you helped to save lives.

A single donor can save eight lives and improve the lives of 75 others by providing organs and tissues. Whether you donate your heart, a kidney or connective tissues, you’ll significantly impact someone’s life. You can become an organ donor in the following ways:

- Register with your state’s donor registry by signing up online.

- Designate your choice on your driver’s license when obtaining or renewing it.

- Tell your family so they know your wishes for donation after your passing.

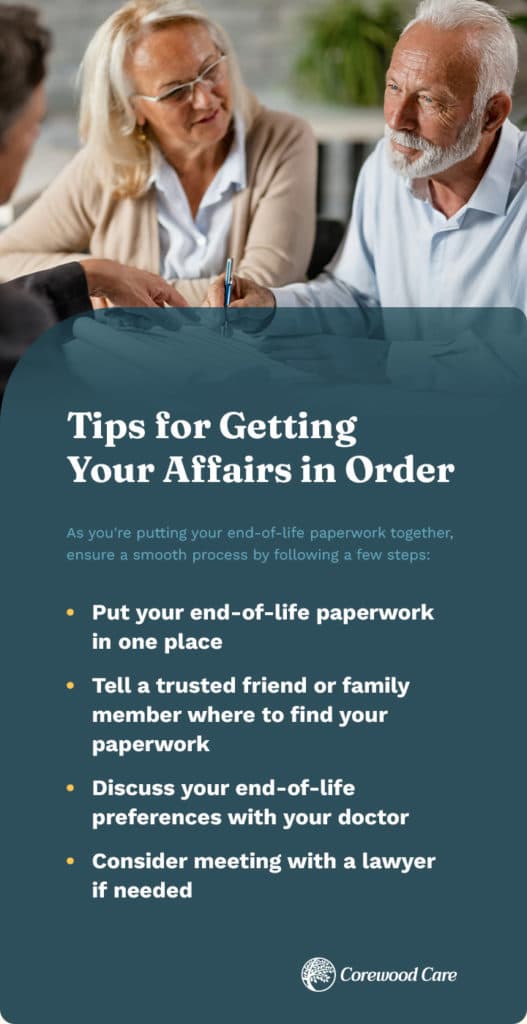

Tips for Getting Your Affairs in Order

As you’re putting your end-of-life paperwork together, ensure a smooth process by following a few steps:

- Put your end-of-life paperwork in one place: Once you’ve gathered the necessary documents, it can be helpful to set up a file on your computer or place the papers in a desk or dresser drawer. You might also keep copies of the files at home if your documents are in a bank safe deposit box. Check these places each year to determine whether there’s anything new you should add.

- Tell a trusted friend or family member where to find your paperwork: List your information and the location of your end-of-life planning documents in a notebook so your family members can easily find them in an emergency. Let your executor, power of attorney agent and other essential people know where to go and inform them of any changes. Ask a lawyer for help if you don’t have a friend or relative you can trust.

- Discuss your end-of-life preferences with your doctor: Talk with your doctor to ensure your healthcare wishes are honored. A doctor can explain the health decisions you might face and available treatment options. You might also permit them to discuss your information with your caregiver.

- Consider meeting with a lawyer if needed: If you have any questions about your legal documents or need someone you can trust, discuss your end-of-life plan with a lawyer. You might talk to them about setting up a trust, general power of attorney or durable power of attorney. By preparing an outline of your preferences ahead of time, you may save time and money on attorney fees.

Schedule an Assessment With Corewood Care

Planning your end-of-life wishes is vital for you and your family if you’re living with a terminal illness or nearing the end of your life. While it may be uncomfortable to discuss, sharing your end-of-life documents with family members ensures you live your last years peacefully and that your family is protected and provided for.

If you’re looking for help for yourself or someone you care for during a life transition, consult with an attorney to organize your documents and trust Corewood Care for support through the process. Our care providers are specially trained to offer solutions and help clients navigate the changes that come from aging and terminal illness. We provide premier guidance and advocate for your needs throughout the process. Contact Corewood Care in Maryland, North Virginia, or Washington D.C. to schedule an assessment.